UK Salon Employees Guide to Tipping Laws, Tax and Compliance

Get compliant

Here’s what you need to know

The Employment (Allocation of Tips) Act came into effect in October 2024.

The legislation applies to ’employer-received’ tips

– i.e. tips paid by card.

According to the legislation, your employer must:

You can complain to the employment tribunal if your employer has not complied with the Act

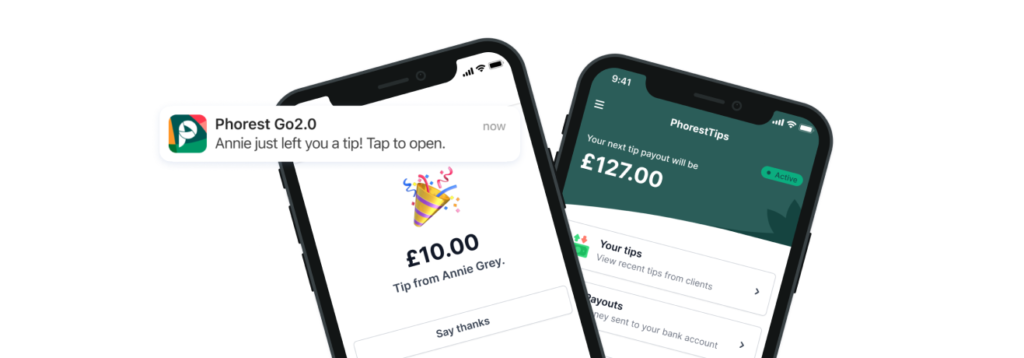

Phorest is one step ahead to support you

Phorest makes things easier by sending your card tips straight to your account, so they are not ‘employer-received’. You’ll get your tips into your account instantly, without any additional taxes.

A Win-Win for Clients, Business Owners & Salon Employees

You will be able to see records of your own tips throughout the year so you can report it to the HMRC at the end of the financial year and stay compliant with income tax laws.

A simple, thoughtful way for your clients to show their appreciation, without the need for cash or QR codes

Already with Phorest?

Get more info

Not yet with Phorest?

Book a demo

Some compliance options available to your employer mean more tax for you. See how much you’ll save with PhorestTips.

Use the slider to input your average monthly tips*.

Standard card

Standard card

PhorestPay card

Cash

Payroll

Tronc scheme

PhorestTips

Cash***

* This example assumes the employee is a basic rate tax payer – i.e. earning between £12,750 and £50,270 per year

**This is an estimate – Tronc scheme fees can vary based on salon size and intricacies of the agreement

***Does not cover tip jar / pooled tips, as these would be considered ’employer-controlled’ so fall under the tipping legislation

Already with Phorest?

Get more info

Not yet with Phorest?

Book a demo